Start Skip-Tracing At 8¢

Skip the struggle and receive instant access to the best data in the industry!

Are you sick of wasting time calling the wrong numbers? It’s frustrating when you waste time calling the wrong numbers... Or have data that is just useless! Need to Skip saves you time and money with quality leads at the click of a button.

WE HELP REAL ESTATE INVESTORS CONNECT WITH HOMEOWNERS!

Are you sick of wasting time calling the wrong numbers? It’s frustrating when you waste time calling the wrong numbers... Or have data that is just useless!

Need to Skip saves you time and money with quality leads at the click of a button.

Skip the struggle and receive instant access to the best data in the industry!

Data and Speed equates to great results, great results amount to high profits! Get an edge over your competitors.

Skip the useless struggle and receive instant access to the best data in the industry!

Data and Speed equate to great results, great results amount to high profits! Get an edge over your competitors.

WHAT IS SKIP TRACING?

Skip tracing is an effective tool to find property owners. This tool is designed to find accurate information on the properties you are trying to acquire. The information can range from the owner's address, phone number or other known relatives associated with the property. This makes for a much easier contact and saves plenty of time!

WE HAVE THE SOLUTION

We are the ultimate platform for Skip Tracing. Our easy-to use and quick to provide information tool, makes Need to Skip one of the most accurate platforms around. We have records from all over the United States at your fingertips!

NEED TO SKIP IS YOUR COMPETITIVE ADVANTAGE

We are one of the few skip tracing companies to not only provide premium quality data, but do so with no monthly contracts. You only pay per result.

WHAT IS SKIP TRACING?

Skip tracing is an effective tool to find property owners. This tool is designed to find accurate information on the properties you are trying to acquire. The information can range from the owner's address, phone number or other known relatives associated with the property. This makes for a much easier contact and saves plenty of time!

WE HAVE THE SOLUTION

We are the ultimate platform for Skip Tracing. Our easy-to use and quick to provide information tool, makes Need to Skip one of the most accurate platforms around. We have records from all over the United States at your fingertips!

NEED TO SKIP IS YOUR COMPETITIVE ADVANTAGE

We are one of the few skip tracing companies to not only provide premium quality data, but do so with no monthly contracts. You only pay per result.

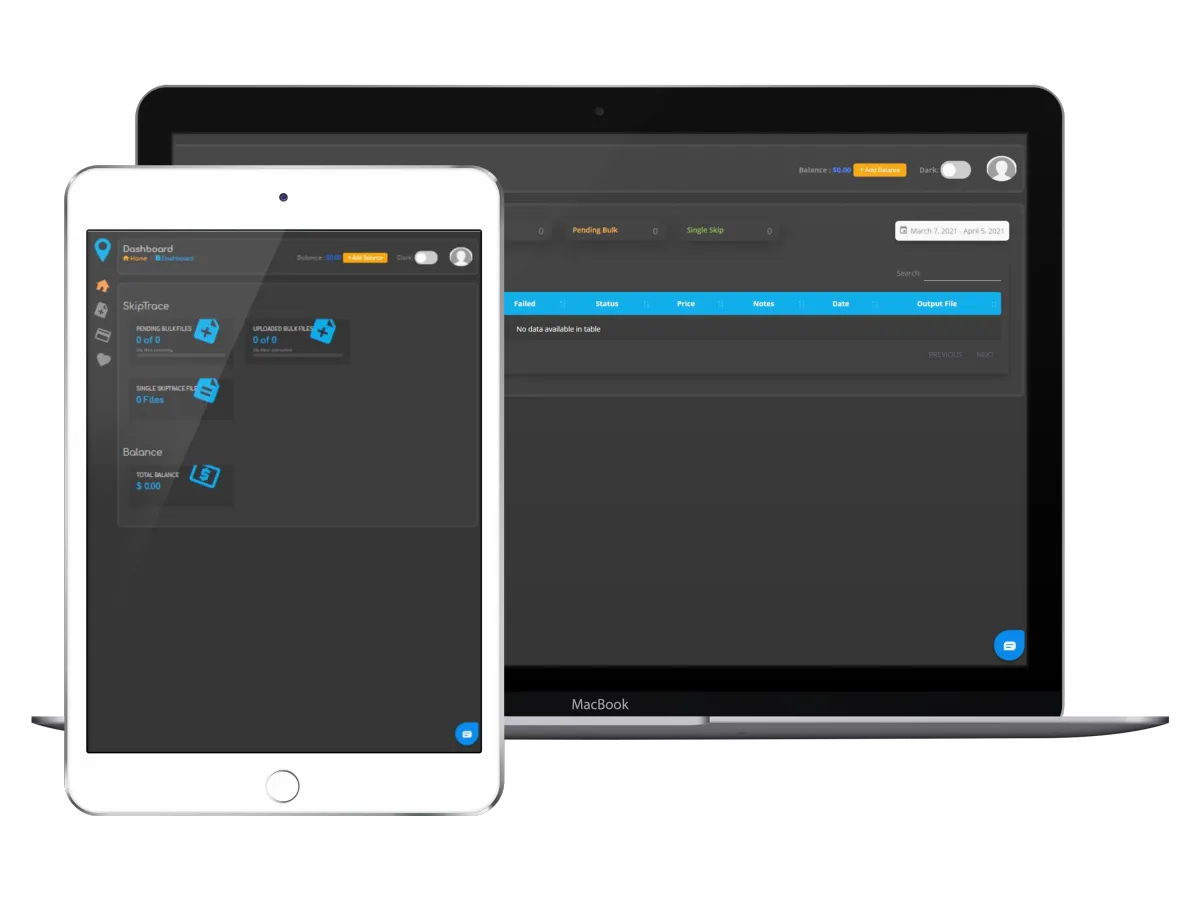

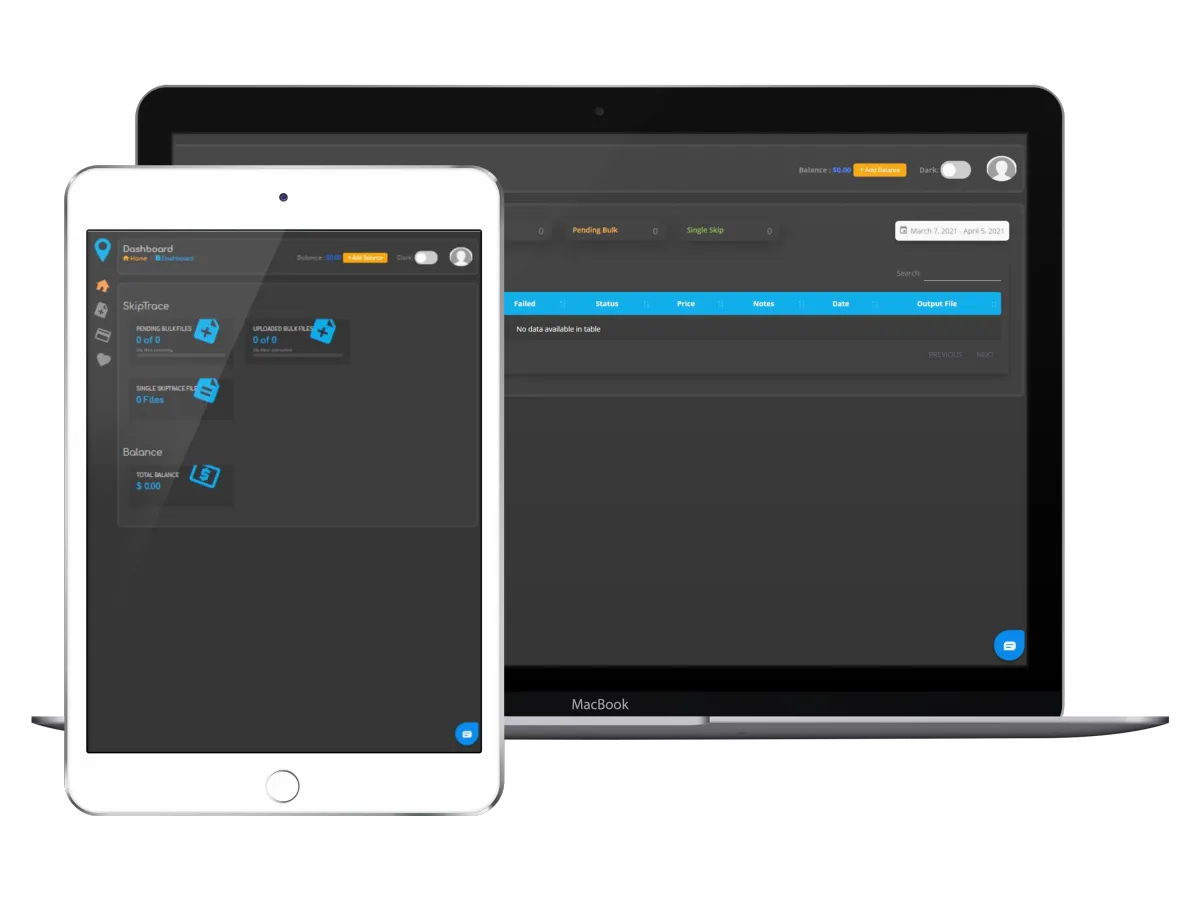

User-Friendly Interface

Access to Nationwide Archives

Valid and Accurate Data

Access to our Largest Databases

Lightning Fast Interface

Advanced Analytics Reports

Bulk Rate Discounts Available

100% Satisfaction Guaranteed

User-Friendly Interface

Access to Nationwide Archives

Valid and Accurate Data

Access to our Largest Databases

Lightning Fast Interface

Advanced Analytics Reports

Bulk Rate Discounts Available

100% Satisfaction Guaranteed

WHY US?

Not all skip tracing services are created equal. Many use outdated information, causing you the headache and hassle when you are trying to contact property owners. We use a multi-data point system to make sure that our data is constantly updated. Whether you are looking for vacant, pre-foreclosure, tax default or other owner/non-owner occupied properties, Need To Skip is the best skip tracing service in the industry.

WHY US?

Not all skip tracing services are created equal. Many use outdated information, causing you the headache and hassle when you are trying to contact property owners. We use a multi-data point system to make sure that our data is constantly updated. Whether you are looking for vacant, pre-foreclosure, tax default or other owner/non-owner occupied properties, Need To Skip is the best skip tracing service in the industry.

FAQ

Our system collects millions of data points from online and offline repositories to get you the most accurate information. Need To Skip is the easiest and best way to connect you with the property owners you’re looking for.

Whether you are performing bulk skip tracing or a single skip trace, we can provide you with very specific address and contact information for every property owner. We also include relatives of the homeowner, relatives’ addresses, and possible phone numbers.

Need To Skip delivers true 200 point data. Our system consistently compares data with the top 3 competitiors. We validate accuracy of the data directly with the credit bureaus.

Typically all orders are completed within Minutes.

NEED HELP?

Our support team is here to help with whatever issues you may have. We have tons of training and self-help resources to help you become an expert with the platform.

FAQ

Our system collects millions of data points from online and offline repositories to get you the most accurate information. Need To Skip is the easiest and best way to connect you with the property owners you’re looking for.

Whether you are performing bulk skip tracing or a single skip trace, we can provide you with very specific address and contact information for every property owner. We also include relatives of the homeowner, relatives’ addresses, and possible phone numbers.

Need To Skip delivers true 200 point data. Our system consistently compares data with the top 3 competitiors. We validate accuracy of the data directly with the credit bureaus.

Typically all orders are completed within 48 hours. Orders submitted on the weekends and holidays are also fully processed.